Africa Angel Investors Network

Africa Angel Investors Network

Supporting startups creating value for Africa

Review | Optimise | Funding

Problem Statement: Globally startups receive $300billion+ per year in funding with Africa getting less that 1% of the total funding. This is how the funding has been deployed so far, check our Funding Tracker

Our Vision is to be a key catalyst for Africa's startup ecosystem through our pre-seed initiatives to leverage Africa's upcoming demographic dividend.

1. Review

We will review your pitch deck and financial model as well as allocate you to our Scout to support you.

2. Optimise

Your allocated Scout will help you optimise your startup through our advisory boards ~ 'Growth Readiness Program'

3. Funding

We will circulate the prepared Investment Memo to hundreds of investors within our network.

Love Money | Pre-Seed

Your minimum viable product 'MVP' must be generating at least $1 in monthly revenue

Reimagine your minicorn journey

We provide early-stage momentum to your startup with our Pre-Seed funding activities such as pitch deck review, Growth Readiness Program, Investment Memo for founders across Africa, working hand in hand with angel investors and venture capital firms across the continent. Below is what an average path to success for your startup looks like, although the journey will be tough we will walk with you. Make use of our funding tracker, to understand pathways for other successful startups across the continent.

What we look for in Outliers

You must be a tech startup modelled for regional success to submit your Pitch Deck; below are some of the key aspects we review in your startup. Our early-stage advisory board and possible funding from our angel investors will help you perfect some of the key issues to stand out from the crowd for regional success! To get insights on our thought process when we review your pitch deck, simply download our seed stage Airbnb Pitch Deck Review.

Impact! Foundation for a strong startup ecosystem is to develop talent early on and one way we are doing this, is by ensuring that 1 in every 100 university students in Africa is able to draft a world-class pitch deck. If you are a final year university student you can participate by simply looking for another team member 'student from a different degree class i.e if you are studying commerce find someone studying sciences or vice versa' to draft a pitch deck [in english] for any startup listed on our Funding Tracker and send it to us through Submit Pitch Deck 'simply select student when uploading,' we will give you a cerficate of competence if you score 50%+ on your pitch deck review and if you score 80%+, we will give you some gifts i.e pocket money for your graduation, books or tech gadgets depening on your score - thanks to our sponsor Kupfuma. Simply follow the instructions to participate as a final year university student, anytime and anywhere in Africa.

If you are a startup founder, the icons below are a guide to help you develop a pitch deck for your startup. Click on each icon to flip it and view more details.

Design

Vision

Problem

Solution

Product

Why Now

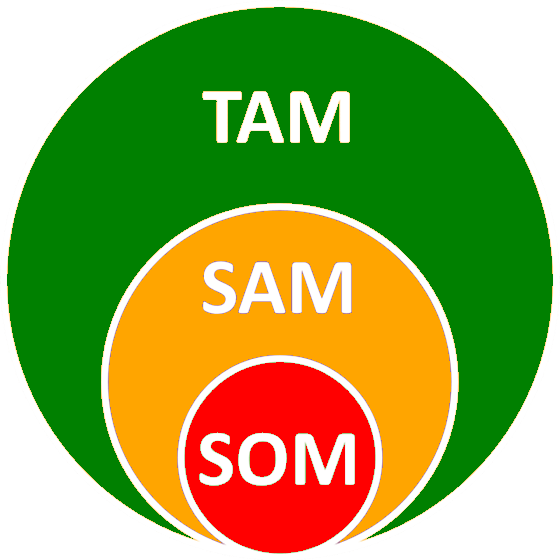

Market Size

Competition

Go To Market

Business Model

Traction

Funds & Pricing

RoadMap

Team

Technologies

A startup is an early-stage business that is designed to bring efficiency to your market and grow exponentially leveraging technology to be at the forefront of market changes, right on time but ahead of the current competition in your market. If your business doesn’t fit out startup definition, you can apply for high growth SME funding through the Kupfuma platform. In simple terms startups create value whilst SMEs extract value.

Talent is equally distributed, but opportunity is not!

For startups the first source of funding is 'love money' from family and friends based on trust and relationship built over time. In developed markets this isn't much of an issue as average GDP per capita is more than $50 000 hence most families and friends can easily scrape together savings to give founders their first funding 'love money’ at generous terms. However, this is a different story in emerging markets mainly in Africa were average GDP per capita is a paltry $2 000 hence most families and friends are not able to fund talented founders within our ecosystem and this is gap we are trying to fill as AfricaAIN by providing advisory and love money to talented founders who are creating value for Africa's growing population needs and wants. We will support your startup from the moment you send us your pitch deck by providing you with a comprehensive pitch deck review, below are the key areas we will support you with.

1. Data Room:

Our data room provides you with a centralised virtual environment for your startup's due diligence documents, making it easier for various investors to undertake basic due diligence within the shortest possible time. This is supported through our e-signature which enables you to sign documents as you fund raise.

2. Growth Readiness:

Our three-month board 'Growth Readiness' program will help you align your startup to growth as well as help us prepare for pre-seed funding book building.

3. Overdraft Facility:

Our interest free overdraft facility of up to $10 000 will help you manage short term liquidity for your startup whilst we are undertaking book building to secure pre-seed funding from our angel investors network.

4. Advisory Board:

We will help you setup a lean and top-notch advisory board to bounce off both tactical and strategic action plans to unlock growth for your startup.

5. Secondaries:

This will help you organize your cap table, ensuring there is no dead weight on your cap table which might hinder you from unlocking growth for your startup.

6. Angel Investors:

Our angel investors provide a strong support network and between $10 000 to $100 000 in pre-seed funding to help you launch and commercialise your MVP.

7. Global Capital Markets:

Our motto is 'Local, with a global mindset,' hence we will help you navigate the global marketplace for further funding and talent to scale up your startup.

Our Thought Process

In 2050 Africa’s population will be over 2.5billion accounting for at least 25% of world’s population meaning more complex problems which need to be solved by talented individuals in Africa, however most of the talent in Africa come from humble backgrounds to access funding to solve the complex problems at scale, hence we are building this platform to be the extended family to support these founders by providing them with advice and love money at an early stage. Some of the solutions to Africa’s problems have gone to the global stage for example Logan Green and a couple of friends during their college break in 2006, visited Victoria Falls in Zimbabwe which was facing a transportation crisis due to fuel shortages hence passengers were waving down cars with spare space on the side of the road. When Logan went back to the USA, he reflected on the observation he had made in Zimbabwe as Santa Barbara the town which he lived had mad traffic jams and more cars than Victoria Falls, he started working on his startup 'Zimride.' At the same time John Zimmer was working on a similar idea and they combined forces to execute on their startup idea. Over time Zimride evolved into Lyft which is current valued more than $5billion, this also gave inspiration to various ride sharing startups across the globe including Uber which is now valued at $150billion+. There are many talented individuals in Africa trying to solve our everyday challenges however struggle to raise patient capital to see through their breakthrough ideas unlike in developed markets where founders can easily access angel investors to support their ideas early on. This is the space we actively participate by supporting founders across Africa

Our Founder Fit

We support visionary founders based in Africa, who are connecting simple technology with brick-and-mortar models to solve Africa’s challenges at scale.

Beyond convectional VC

- Our constructive feedback loop help startups reflect and improve over time.

- We evaluate each startup as a winner, we are not chasing unicorns but minicorns.

- We take time to evaluate each startup on a case-by-case and give tailor made feedback.

- We provide support at board level in addition to financial support.

- We want to build strong relationships and treat our startups as family or friends.

Angel Investors Scout Program

To get in the veins of Africa’s startup ecosystem we are building a strong network of Angel Investors Scouts across Africa, our scouts are bold and ambitious individuals who thrive within startup communities across the continent and are practical about creating value for Africa by working hand in hand with dedicated founders. Our scouts are professionals who want to take their career to the next level by seating on boards and having equity in startups who are shaping the future of Africa. Some of the benefits for being part of our scout network include:

- Accelerate and broaden your career path

- Earn extra income through deal and board fees

- Build wealth through equity i.e stock options

- Grow your network with like minded people

- Gain a deep understanding of Africa's start-ups ecosystem

If you are a young professional aspiring to be a venture capitalist or angel investor in the future, we can give you a head start through our Africa Angel Investor Scout program, simply submit your CV through the icon below and if you are an existing scout simply log in to your account to help us build Africa.

...

Voices from our ecosystem

‘Brainstorming and being accountable through advisory boards with the team has been a key differentiator’

Anopa - Founder

Harare, Zimbabwe

‘Great way to invest in startups back home and not miss in action. I am also leveraging my human resources skills supporting startups'

Ivy - Human Resources

London, UK